mass wage tax calculator

On the first 15000 each employee earns Massachusetts employers also pay unemployment insurance of between 094 and 1437. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Massachusetts Paycheck Calculator Tax Year 2022

Calculating your Massachusetts state income tax is similar to the steps we listed on our Federal paycheck.

. 17 if they didnt make the initial April 19 deadline. The Massachusetts Income Tax Calculator Will Let You Calculate Your State Taxes For the Tax Year. Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free.

It doesnt matter how much you make. So the tax year 2022 will start from July 01 2021 to June 30 2022. Your average tax rate is 1666 and your marginal tax rate is 24.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. As of January 1 2020 everyone pays 5 on personal income. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and.

If you paid at least 80 of your tax bill in April you qualified. Your average tax rate is 1198 and your. Massachusetts Income Tax Calculator 2021.

New employers pay 242 and new. Massachusetts Hourly Paycheck Calculator. Massachusetts has a 625 statewide sales tax rate.

Just enter the wages tax withholdings and other information. 15 Tax Calculators 15 Tax Calculators. See where that hard-earned money goes - Federal Income Tax Social Security and.

The Federal or IRS Taxes Are Listed. Contacting the Department of. Residents must file their 2021 personal income tax returns by Oct.

After a few seconds you will be provided with a full. In this past fiscal year Fiscal Year 2022 FY22 Massachusetts tax revenue collections exceeded the annual tax revenue cap set by Chapter 62F of the Massachusetts General Laws by 2941. The Massachusetts Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and.

The total Social Security and Medicare taxes withheld. If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. Payroll taxes in Massachusetts Massachusetts income tax withholding.

To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. However depending on how much you make in a year you. In 2022 and possibly in 2023 any taxpayer who generates income in Massachusetts will be charged with a 5 state income tax.

If you make 122500 a year living in the region of Massachusetts USA you will be taxed 26314. The amount of federal and Massachusetts income tax withheld for the prior year. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

This marginal tax rate.

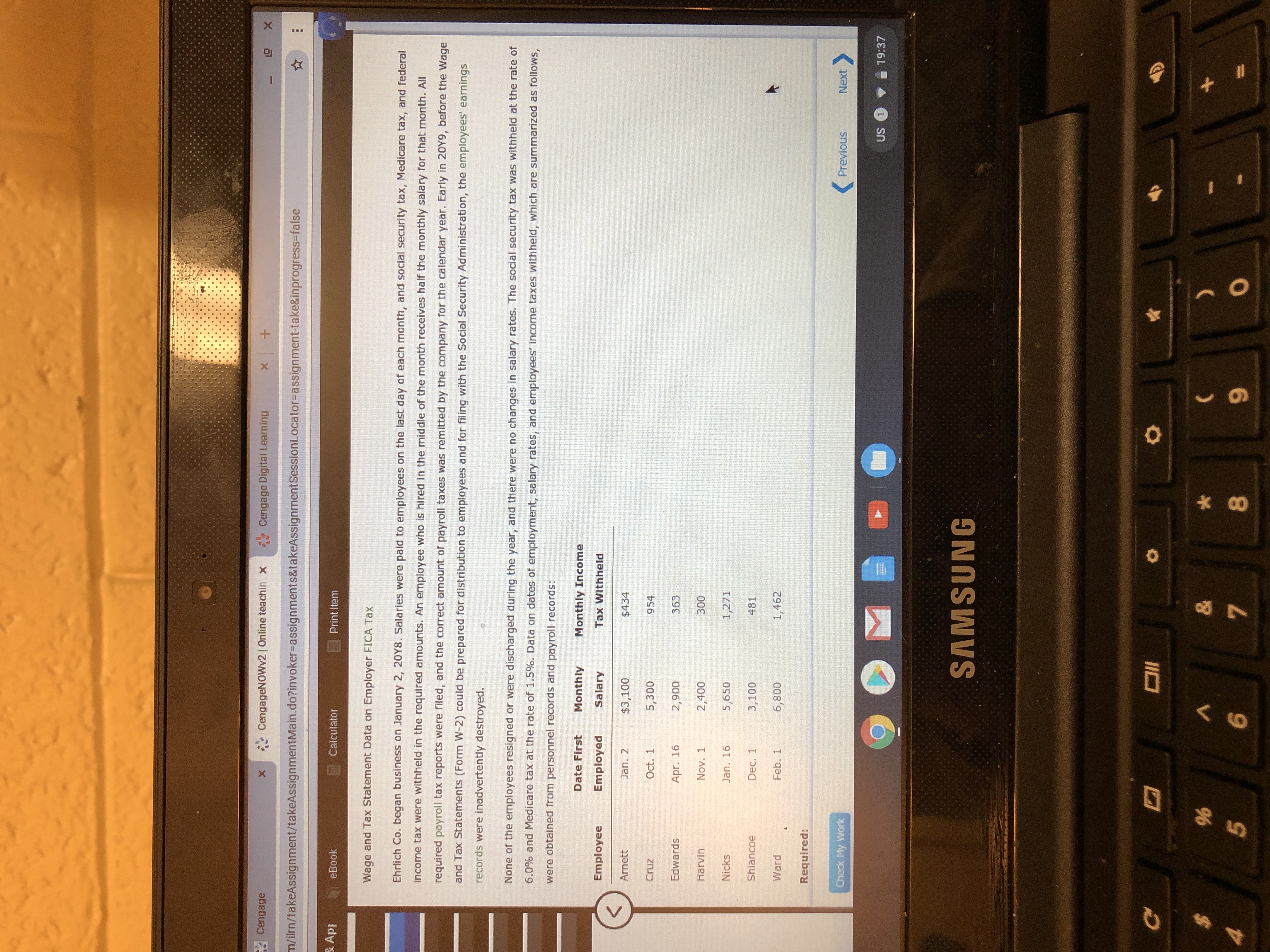

Answered Cengage Cengagenowv2 Online Teachin X Bartleby

Free Massachusetts Payroll Calculator 2022 Ma Tax Rates Onpay

How To Calculate 2019 Federal Income Withhold Manually

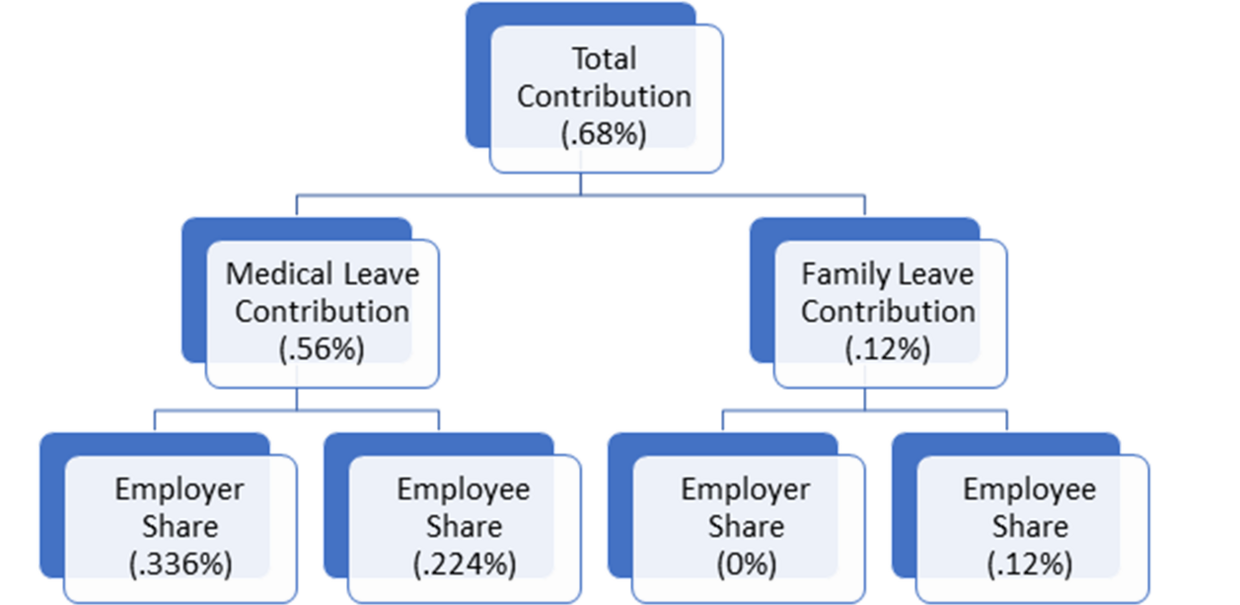

Paid Family And Medical Leave Employer Contribution Rates And Calculator Mass Gov

Free Income Tax Calculator Estimate Your Taxes Smartasset

Time For Income Tax Return Text On Sticky Note With Tax Form Calculator Pen And Glasses Background Stock Photo Adobe Stock

How To Calculate Massachusetts Income Tax Withholdings

Llc Tax Calculator Definitive Small Business Tax Estimator

Car Tax By State Usa Manual Car Sales Tax Calculator

Prepare And E File Your 2021 2022 Ma Income Tax Return

Alimony Still Deductible For Massachusetts State Income Tax Return Filers

Estimated Income Tax Payments For 2022 And 2023 Pay Online

New York Hourly Paycheck Calculator Gusto

Tax Withholding For Pensions And Social Security Sensible Money

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog